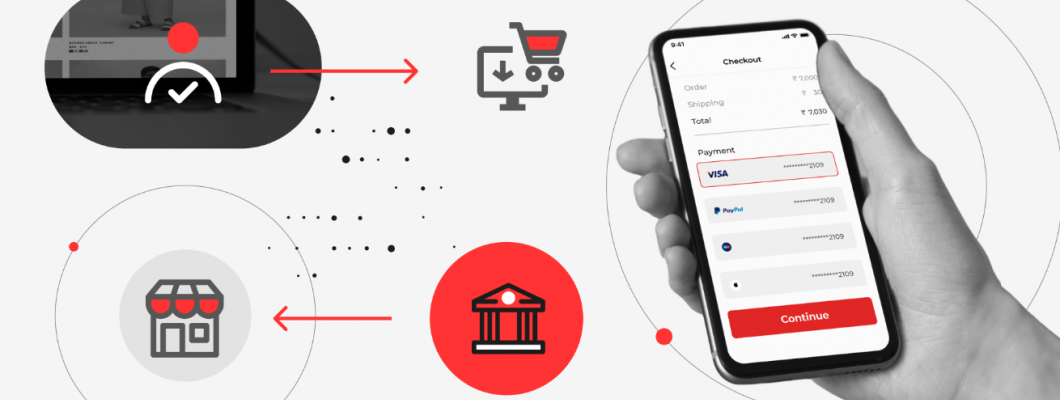

In today’s fast-moving digital world, providing a smooth and secure checkout process is vital for any online business. Whether you’re managing an e-commerce site, a subscription platform, or a mobile app, the way you handle transactions directly impacts user trust and conversion rates. A well-integrated payment gateway ensures that your customers can complete purchases quickly, safely, and without unnecessary friction.

Payment gateway integration is more than just accepting credit cards; it’s about creating a seamless transaction flow that supports multiple payment methods, encrypts sensitive data, and complies with security standards like PCI DSS. It’s also key to reducing cart abandonment and boosting customer satisfaction.

This blog will break down the essentials of payment gateway integration: what it is, why it matters, and how to implement it effectively. From choosing the right provider to ensuring compliance and offering a frictionless user experience, we’ll cover the critical steps to help you build trust and streamline payments, ultimately driving more revenue for your business.

What is a Payment Gateway?

A payment gateway is a technology that captures and transfers payment data from the customer to the acquiring bank. It acts as a bridge between your website/app and the financial institutions involved in the transaction process.

It ensures that:

Payments are encrypted and secure

Transactions are authorized and validated

Funds are transferred correctly from the buyer to the seller

Examples of popular payment gateways include:

Stripe

PayPal

Razorpay

Square

Authorize.Net

Braintree

Why Payment Gateway Integration Matters

A good payment experience can make or break a sale. Here’s why integrating the right payment gateway is essential:

1. Security Compliance

Your checkout system must be PCI DSS compliant to protect sensitive cardholder data. Payment gateways are designed with advanced encryption and tokenization to ensure compliance and security.

2. Seamless User Experience

A complicated or slow checkout process leads to abandoned carts. Integrated gateways offer faster checkouts, saved card details, and mobile-friendly interfaces, reducing friction and improving conversions.

3. Multiple Payment Methods

Today’s customers expect flexibility. Integration allows you to accept:

Credit/debit cards

UPI and mobile wallets

Net banking

Buy-now-pay-later (BNPL) services

4. Global Transactions

If you sell internationally, payment gateways can support multi-currency payments and localized options, ensuring a smooth experience for global buyers.

Key Features to Look For

When choosing and integrating a payment gateway, consider these essential features:

Fraud detection & prevention tools

Recurring billing capabilities for subscriptions

Easy refund & dispute management

Real-time reporting & analytics

Customizable checkout UI/UX

Mobile SDK support for apps

Developer-friendly APIs & documentation

Steps to Integrate a Payment Gateway

Here’s a basic roadmap to integrating a payment gateway into your website or app:

Step 1: Choose the Right Gateway

Evaluate based on:

Supported countries/currencies

Transaction fees and pricing

Integration complexity

Customer support

Reputation and reviews

Step 2: Set Up a Merchant Account

Some gateways require a separate merchant account to process funds. Others (like Stripe and PayPal) provide an all-in-one solution.

Step 3: Get API Keys or SDK

Once your account is approved, the gateway will provide:

API keys (for web-based integration)

Mobile SDKs (for Android/iOS apps)

Step 4: Integrate with Backend & Frontend

Your developers will need to:

Add payment form UI (frontend)

Call gateway APIs to process transactions (backend)

Handle errors, payment success/failure, and store transaction data

Step 5: Ensure Security & Compliance

Implement:

SSL certificates

Data encryption

Tokenization

PCI DSS compliance measures

Step 6: Test in Sandbox Mode

Before going live, test all possible scenarios:

Successful payments

Failed transactions

Refunds

Recurring billing

Step 7: Go Live & Monitor

Switch to live mode and monitor:

Payment success rate

Drop-off points in checkout

Customer feedback

Common Challenges (and Solutions)

Challenge: High Cart Abandonment

Solution: Enable guest checkout, auto-fill options, and fewer form fields.

Challenge: Security Concerns

Solution: Use a PCI-compliant payment gateway with fraud protection features.

Challenge: Integration Complexity

Solution: Choose gateways with plug-and-play plugins for platforms like Shopify, WooCommerce, or Wix.

Best Practices for a Seamless Checkout

Keep the checkout process short and intuitive

Offer multiple payment methods

Display trust badges and SSL certificates

Provide a visible support/contact option

Allow users to save cards securely for future payments

Use responsive design for mobile users

Conclusion

A secure and seamless payment gateway integration is not just a technical requirement it’s a strategic investment in your customer experience. The right integration can build trust, reduce cart abandonment, and boost your overall revenue.

Whether you're starting a new venture or optimizing an existing one, prioritizing your checkout experience is key. Choose a reliable gateway, integrate it properly, and keep testing and refining the process.

Leave a Comment